Get the free 8962 fax number

Show details

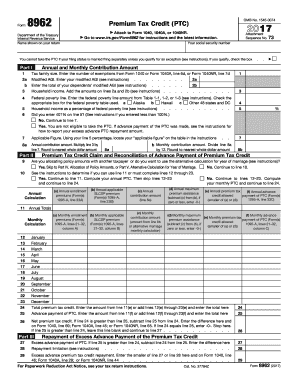

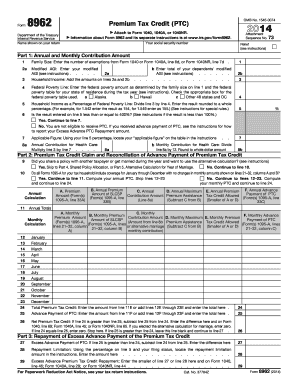

For example, my full cost premium for a Blue Shield Bronze HSA plan ($4500 ..... your post from http://www.cahba.com/blog/2013/11/magi.html in quotes below. ... Here is a link to a draft form for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs fax number for 8962 form

Edit your irs fax number for 8962 and 1095 a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8962 fax number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit where do i fax my 8962 form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit where to fax form 8962. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fax form 8962

How to fill out where do I fax:

01

First, gather all the necessary documents and information that you need to fax. This may include forms, letters, or any other paperwork that needs to be transmitted.

02

Find a fax machine or a fax service that you can access. This can be a physical fax machine at your workplace, a local business center, or an online fax service.

03

Ensure that you have the recipient's fax number. This is crucial for successfully sending your fax. Double-check the number to avoid any errors.

04

If you are using a physical fax machine, place the documents you want to fax in the document feeder or on the fax machine's glass. Make sure they are properly aligned and oriented.

05

Enter the recipient's fax number on the fax machine using the keypad. Follow the instructions provided by the machine or the service to enter any necessary dialing codes or extensions.

06

If you are using an online fax service, log in to your account and follow the instructions provided by the service on how to upload your documents. Enter the recipient's fax number as required by the service.

07

Once you have entered the recipient's fax number, press the appropriate button or select the necessary option on the machine or online service to start sending the fax.

Who needs where do I fax:

01

Individuals or businesses who need to send important documents or paperwork to another person or organization may need to use a fax machine or fax service.

02

Professionals such as lawyers, doctors, or real estate agents often rely on faxing to transmit confidential or legally binding documents to their clients or colleagues.

03

Companies that deal with paperwork-intensive processes, like insurance companies or financial institutions, may require faxing as part of their standard operations.

04

Government agencies or departments may still rely on fax machines or fax services for official document exchanges, especially when dealing with sensitive information.

05

Students or educational institutions may need to fax certain documents, such as transcripts or applications, as part of the admissions process or for official purposes.

In summary, anyone needing to send important paperwork or documents to another person or organization may require the use of a fax machine or fax service. The process of filling out where to fax involves gathering the necessary documents, finding access to a fax machine or service, entering the recipient's fax number, and initiating the fax transmission.

Fill

where do i fax form 8962

: Try Risk Free

People Also Ask about where to fax irs form 8962

Where do I fax 1095a to IRS?

Preparing the form Or you can write to the Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Who do I send my 8962 form to?

The IRS issues Letter 12C to inform a taxpayer that their return has been received, but additional information is needed in order to process the return. If your Letter 12C indicates that Form 8962, Premium Tax Credit was missing and not attached to your return, you will need to send the completed Form 8962 to the IRS.

How do I fax a form to the IRS?

Mail or Fax Form SS-4: Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

What is the fax number for IRS forms?

IRS Fax Numbers 855-641-6935: Anyone within the 50 states and the District of Columbia can use this fax number. 855-215-1627: If you don't have a legal residence or a business address in the U.S. but are located within the States when faxing, use this number.

How do I fax a tax form?

You cannot fax your Form 1040 directly to the IRS. ing to their website, there are two official ways you can file your income taxes: via mail or online. The IRS also allows you to send your tax returns via registered mail. This is a secure and easy way to get the job done.

Where can I fax 8962?

Select Compose Fax. Enter 1-855-204-5020 as the recipient's fax number. Click the clipboard icon to attach the tax form 8962 along with the tax return and cover page.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fax number to send form 8962 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your irs form 8962 fax number into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the fax number for form 8962 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your fax number for irs form 8962 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out fax number irs form 8962 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your irs fax number to send form 8962. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your 8962 fax number form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is The Irs Fax Number For Form 8962 is not the form you're looking for?Search for another form here.

Keywords relevant to irs fax form 8962

Related to can i fax form 8962 to irs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.